Feb 11, 2014 Property

How many times can you be outbid at auctions before you go mad?

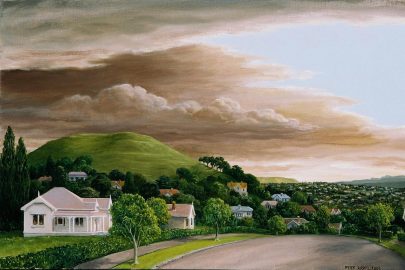

First published in Metro, October 2013. Illustration by Scott Kennedy.

This is how fast it happened: at the beginning of the week, we were happy renters, without the desire or ability to buy a house. Then somebody posted a link on Twitter, we looked at some pictures, and a few days later we were standing with an agent in the kitchen of a house in Kelston, caring about nothing so much as owning that house.

It was a plain old three-bedroom weatherboard place on a rambling section that would be perfect for the family we would be starting six months hence, except for the fact that we had no interest in buying a house and even less interest in buying a house in Kelston.

The area didn’t look nice. No self-respecting agent would even say it looked like it was coming up. But the house was down a private driveway and it was on the water — a mangrove swamp if you really want to be a dick about it — and once you were on the back deck, it could have been miles from anywhere. It wasn’t — it was in Kelston — but once the idea of your own home has sucked you into its world of possibilities, reality is as nothing to you.

So there we were. We had no more money than a few days earlier, when we were hardly rich enough to rent our existing tiny flat, but the thought of owning that place suddenly filled us with strange, unjustified dreams of a brighter future.

By most measures, this was the middle of the least affordable property market in history. But you get the property market you deserve, or at least the one your parents’ generation created for you, and you say, “Well, everybody’s in the same boat!” and you prepare to plunge into crippling debt because everyone you know tells you to, because they have.

And although the Herald and others sometimes run confusing columns on why it’s sometimes better to rent, you can’t be expected to understand them, or to believe them, in the face of all that well-meaning advice.

We went back to the Kelston open home the following weekend, possibly even the following two weekends, with our parents. I got a QV report telling me the house’s selling range would be $380,000 to $450,000.

We met a mortgage broker at a hastily arranged lunch meeting on Ponsonby Rd and bought her an organic cola. She told us that based on my wife’s income and the fact we had a deposit, we could borrow an implausible amount of money. She didn’t mention my income and I think the implication was that we never should.

We sent her some information and a few days later we were pre-approved to buy a house for up to $550,000. It was a scaled- down version of the original implausible figure, but still we decided not to buy anything approaching it, figuring it would imprison us in a debt from which we would likely never escape.

The auction was at Barfoot & Thompson’s Shortland St auction rooms on a weekday morning — I think a Friday. It was a pleasantly appointed room, crammed with more than 100 people, and our property was first on the block.

Where bidding started, I can’t remember, because it moved at a terrifying pace through the 400,000s, where we were willing to bid, and into the 500,000s where any meaningful measure of value became irrelevant. Eventually two bidders remained: an older couple sitting directly behind me, and a middle-aged man standing at the back of the room.

As bidding hit the 600s, the older guy said to his wife: “Who is it?” She looked back, and whispered something about the other guy. “Fuck!” he said, and raised the aggression of his bidding, thrusting his hand in the air, increasing his bid multiples.

But none of that mattered because the middle-aged man at the back just kept his hand in the air and never put it down, never wavered. What figure would he have gone to? I doubt he cared. At the ridiculous figure of $652,000, the older couple walked out and he was the new owner of a small, swampy, overpriced corner of Kelston.

I walked out of the auction and found Shortland St looking strange and different. Reality seemed to have come slightly unmoored. I recognised a young, professional couple crossing the road ahead of me. They had been early bidders on the Kelston property.

I asked them what they thought about paying $652,000 for a property in Kelston. They thought it was crazy. “I think it’s an anomaly,” she said.

I wanted to believe her.

That should have been it, in theory. We had not been interested in buying a property, we had become interested in buying a property, we had discovered that property to be massively beyond our means. The next logical step was to return to our uninterested equilibrium.

But the world of property is no respecter of logic. Not only were we now interested in property, we were consumed by it.

It wasn’t that we were blinded to the potential problems. Hardly a week went by in the next few fevered months when I didn’t say to Zanna, “What are we doing trying to buy in the most overheated property market in history?” or similar.

Hardly a week went by without me forwarding her some cautionary Herald article about why it was a bad time to buy. But still, no weekend went by without us driving to a cavalcade of open homes, scrawling price estimates, possibilities, problems across our sheets of TradeMe print-outs.

We had been married a few months before. Our first baby was on the way. We had a long and hopeful future spread before us. We imagined that future intimately and decided it would be in Te Atatu.

Why did we make that decision? I don’t know. Like so many of the decisions we made during that period, our justifications seemed to be post-hoc and flimsy. We knew a few people out there and had already looked at a couple of places, so we had some tiny idea of the area’s value. It seemed like the most central place we could afford. It had shops.

The first Te Atatu place we became really interested in was at the end of a delightful cul-de-sac. The name of the street was also Zanna’s uncle’s name and the number was the number of my childhood home. It had a lovely flat lawn and fruit trees. It had a shed and a strange but pleasant conservatory. These weren’t things that we were necessarily looking for, but once we saw them, they absolutely were.

It quickly became the only house we had ever wanted. The agent said interest had been in the 400s. I went to the auction. It was at the Barfoot & Thompson offices in Shortland St. Interest was quickly apparent beyond the 400s and into the high 500s, setting a pattern we would see repeated again and again: agents would tell you interest was at one level, your hopes would rise, then the property would sell for an extra $100,000 or more. We came to learn that, “It will probably have a four in it,” came with the unspoken rider, “If it’s still 1998.”

You would think we would have just recalibrated and started looking at cheaper properties. But we didn’t. Have you ever looked at the type of place that “will probably have a three in it”? It’s fine to sit there high and mighty and say first home buyers have to adjust their expectations, but do you understand how much adjustment is involved here?

It’s a tough argument, because you don’t want to look like the person quoted recently in the Herald who said prices are so ridiculous that she had been reduced to looking in West Auckland. It’s a question of what’s reasonable.

The median price of Auckland dwellings was $272,000 in 2003. By the middle of this year, it was $562,000 and rising steadily. Over the past year alone, median prices have risen 12 per cent. What is the logic to that? How is that reasonable?

In a Demographia study earlier this year, Auckland housing prices were shown to be 6.7 times the city’s median household income. Anything over five is considered “severely unaffordable”. There is no category above “severely unaffordable”. Of all the worldwide cities in the study with over a million people, only nine had a higher median multiple.

As our search went on, I quoted figures and studies like this to Zanna with such regularity that I think she grew to despise me.

“Greg thinks we’re in a bubble,” she said to her father over dinner one night, presumably in the hope he would dismiss my concerns.

“We are,” he said.

“He thinks it’s going to burst,” she said.

“That’s probably right too,” he said.

Battling within me were two fears. I feared that if we bought at that time, we would be buying just before the market died, leaving us financially exposed. But I also feared that if we didn’t buy at that time the exploding market would leave us behind, with even less chance of being able to afford a decent place to live.

Once in this awful catch-22, there appeared no way out. My life became an endless cycle of emailed TradeMe alerts, prodigious open-home schedules and early-week follow-up phone calls from real estate agents. We would go to open homes, hear sweet lies about expected value, go to the auction anyway, watch bidding spiral beyond us, walk out into the Dali-esque atmosphere of a city that had come unhinged from the idea of inherent value, and we would start again.

For whatever reason, I never felt completely hopeless, which in some ways made it worse. There was always the feeling that this particular open home might be the one where nobody appreciates the value and we could sneak in a lowball offer only a slightly ridiculous amount above its actual value. But the longer we spent in the market, the more obvious it became that this was crazy thinking for which there was no evidence. It was the same logic that leads people to believe they will one day win the lottery.

But Oprah has always said that if you put something out to the universe you get something back, and although I have never believed that to be true, a long spell in the Auckland property market will make you reconsider many things.

This was the context in which — some months into our search — the email arrived. A family member had seen a property they wanted to help us buy. It would be a partnership thing. It was a nice, small 1980s three-bedroom brick house in a nice neighbourhood, on a smallish section. Although it was neither the type of house nor the type of location we had been interested in, it quickly became everything we had ever wanted and the only place in which we had ever wanted to live.

We found a list of recent sales in the neighbourhood and, based on those, we calculated what we thought it would go for. Something in the early 800s seemed likely. Finance was sorted and our lawyer looked over the title and other legal stuff. It all looked good. At the final open home, we got a ladder and checked the gutters.

I went to the auction. It was at Barfoot & Thompson in Shortland St. I found myself standing with an agent. He encouraged me to start the bidding, which I refused to do until I found myself doing it, at $780,000. The room turned to me. I felt proud and terrified.

For a long time, nobody countered and I entertained the thought of drinking champagne at my new breakfast bar later that night, but that hope died with the sound of the auctioneer calling $800,000. Such a simple thing, the raising of a hand, the calling of a number: it was hard to believe there could be so much weight behind it.

“If you’re serious, come right back at him,” the agent whispered to me. Was I serious? I was beginning to doubt it. I raised my hand anyway. “820,” said the auctioneer, pointing at me. Our limit was 840, maybe 850 if it looked like we might get it by stretching.

Barely was my hand down when the auctioneer pointed across the room and called 840. He looked immediately back at me, as did the rest of the room, and he asked for 860. Seconds before, I had bid at 780. I knew this was how auctions worked, but not that this was how they felt.

I shook my head and looked at my feet, ashamed and disappointed. Immediately, somebody else bid at 860. Seconds later, somebody else said 900. New bidders entered, several of them, people who had not even bothered bidding until my piddling limit had been passed.

$995,000 it sold for. Who got it, I don’t know. I left into the murky morning, wondering how we suddenly had double the amount of money to play with, but just as little prospect of buying a house.

But of course I knew. It didn’t matter whether we had $400,000 or $1 million to spend, if we felt a house was overvalued, we weren’t prepared to buy it, and it seemed increasingly obvious that everything was overvalued: the unprecedented rise in prices over the past decade, the outrageous median multiple of 6.7, the open homes swarmed by rabid buyers, the endless bringing forward of auctions because of the exorbitant pre-auction offers.

In describing my consumer persona, Zanna recently told a friend: “He’s constantly afraid that everybody is trying to pull his pants down when he’s not looking.” This is a true statement, but in the Auckland property market, it looks to me like the only way to buy a property is with your pants down.

But no matter how strongly I felt about the overheated market and the fact we would never find something we deemed reasonable value, I didn’t want to stop looking. Because, as real estate agents understand and never tire of mentioning, you buy homes with your emotions.

When I looked at a house, I imagined my future children laughing and playing on the lawn. I imagined parties on the deck and tearful episodes of future television soaps in the lounge. I created memories in advance and I fell in love.

Love is nothing though. In a market like this one, where you can turn up to an open home 10 minutes early and still struggle to park your car, and where you can reasonably expect to have to queue in the hallway to get a look at the bathroom, the more powerful emotion is fear: fear that you’ll never get into a house, that these hordes of open-homers are all richer than you, are prepared to offer more than you, are more desperate than you. And those people are thinking the same thing about you.

I’m not saying that fear is necessarily the driver behind this crazed market we’re in, but nor am I saying it isn’t.

By the time we’d missed out on the $995,000 property, Zanna was nearly seven months pregnant. The idea of moving house and setting up started to seem too difficult, and gave us a reason to break the cycle that I believe would otherwise have driven us to do what it seemed like so many of the city’s young families had done — engage in a debt that was far beyond reasonable, for a house that didn’t warrant it.

We agreed that we would start looking again when our baby is old enough for us to again take regular showers. Part of me hopes we don’t, but that’s my rational side. Part of me fears that my rational side will be overruled. Part of me hopes that it will. Part of me doesn’t know what’s rational anymore.